Major Indexes on Portfolio Benchmark

A benchmark index gives the investor a point of reference for measuring a portfolio's performance.

|

The Standard & Poors 500 Index has been widely used as the basic benchmark for stock-oriented portfolios. Often considered a surrogate for the overall market, this index is composed of the stocks of 500 of the largest companies listed on U.S. exchanges. The S&P 500 Index is market-cap-weighted, which means that the importance of individual stocks in the index depends upon the stock's market value. Therefore, a percentage change in the market value of a large company has a greater impact than an identical percentage change in a smaller company.

As the most popular single index benchmark, the S&P 500 Index is also used for those portfolios where no other standard benchmark is readily available for comparison, such as domestic-hybrid, international-hybrid, and convertible-bonds. For any fixed income portfolio, the Lehman Brothers (now Barclays) U.S. Aggregate Bond Index is used as the standard benchmark index. This index is a combination of the Government, Corporate, Mortgage-Backed, and Asset-Backed Securities indexes. Note that it contains no high-yield issues. In 2014, S&P Global also created a similar bond index with value started in 2002. The bond index can be used together with the S&P 500 Index to form a simple blended benchmark such as a 60/40 benchmark (60% S&P 500 and 40% bond). Other single market index can also be used as the benchmark for a specific portfolio. |

|

A Portfolio Index benchmark can be created by a combination of multiple well-selected single market indexes. A set of popular portfolio benchmarks defined below are used to evaluate a portfolio's performance for the given risk tolerance level, ranging from Short-Term (100% cash or 3-Month T-Bill), Conservative, Moderate Conservative, Moderate, Moderately Aggressive, to Aggressive.

|

|

A Theme-Based Benchmark Index is a portfolio of ETFs following a predefined trading rules. Each Theme-Based index creates a customized benchmark that reflects an investor's personal circumstances (a Theme) such that the most relevant comparison can be made for a portfolio as a whole.

Most portfolio managers today recognize that applying a traditional single market index such as the S&P 500 Index often encourages short-term thinking and possibly even too much trading. For those investors already in retirement, they do not even feel they need a irrelevant and misleading blended benchmark which is often applied today, as the main consideration for them are simply having sufficient income. The Institute for Systematic Investing Research (ISIR) has long been dedicated to the development of theme-based portfolio benchmarks. Thanks to the rapid growth of ETF industry, the creation of Theme-Based Benchmark Indexes has recently become a reality. The new Theme-Based Benchmark Indexes created by ISIR include

Note that each of the above Theme-Based Benchmark Indexes is defined and backed up by a real ETF portfolio (to be published) and follows the Global Investment Performance Standards to possess the following properties as a valid benchmark:

|

Other Notable Indexes on Portfolio Benchmark

The choice of benchmark can greatly influence decisions throughout the investment process and effectively measure a portfolio manager's skills and track record. Other significant benchmark indexes for performance measurement include

The above indexes represent examples of the popular single and blended benchmark indexes as well as the newly developed Theme-Based benchmarks by ISIR. If you believe that any other significant benchmark index should be included here, please contact us.

- The MSCI ACWI Ex-U.S. Index (All Country World Index Ex-U.S.) is market-capitalization-weighted index maintained by Morgan Stanley Capital International (MSCI) and designed to provide a broad measure of stock performance throughout the world, with the exception of U.S.-based companies. The MSCI All Country World Index Ex-U.S. includes both developed and emerging markets. For investors who benchmark their U.S. and international stocks separately, this index provides a way to monitor international exposure apart from U.S. investments.

- The NASDAQ U.S. Broad Dividend Achievers Index is an objective composite of companies with a history of increasing dividend payouts. This select group of companies is committed to enhancing shareholder value through the return of capital to shareholders. The Dividend Achievers history traces back to 1979, when Moody's Investor Service developed a proprietary model to identify best-of-breed dividend-paying companies. Nasdaq acquired the brand in late 2012 and added rules-based methodologies to make the indexes more transparent for investors. This index provides an easy benchmark to measure U.S. dividend growth portfolios.

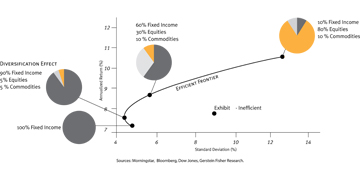

- Other Global Blended Benchmarks are created using market indexes for measuring portfolios dynamically adjusting asset allocations while maintaining diversification across global capital markets. Examples (re-balanced monthly) include

- The Global Conservative Benchmark is comprised of 20% MSCI ACWI, 75% Barclays U.S. Aggregate Bond Index, and 5% S&P GSCI.

- The Global Growth Benchmark is composed of 55% MSCI ACWI, 40% Barclays U.S. Aggregate Bond Index, and 5% S&P GSCI.

- The Global Aggressive Benchmark is comprised of 70% MSCI ACWI, 20% World Government Bond Index, and 10% S&P GSCI.

The above indexes represent examples of the popular single and blended benchmark indexes as well as the newly developed Theme-Based benchmarks by ISIR. If you believe that any other significant benchmark index should be included here, please contact us.